BENY Token Model

BENY Token

The BENY token is a utility token used to pay usage fees and to elevate a user access on the BennyFi platform. It is also distributed to Pool Managers as a reward for the creation and execution of successful pools.

Token Name: BennyFi entry token

· Ticker: BENY

· Blockchain: Telos https://mainnet.telos.net

· Token Standard: eosio

· Contract: dapp.beny

· Token Type: Utility

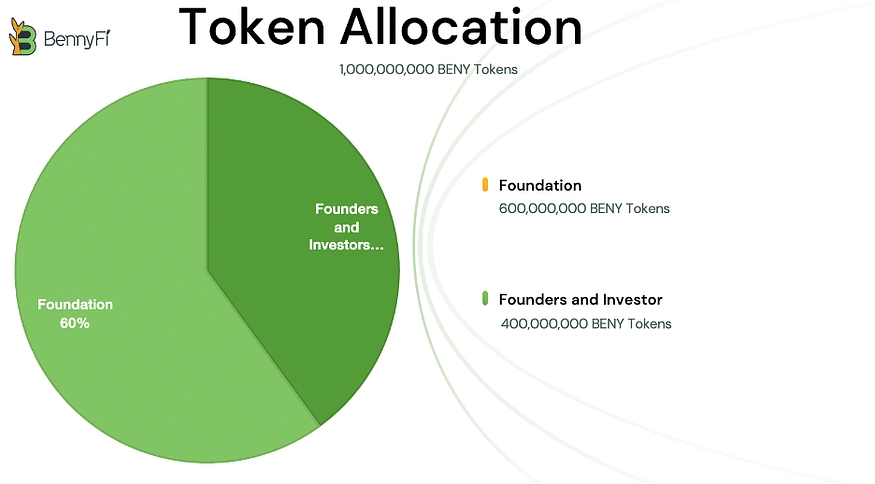

· Max Supply: 1,000,000,000 BENY

· Issuance per the Foundation’s budgeting proposal process (see Governance)

Managing the BENY token

The BennyFi platform is designed to maximize the systems value, to the benefit of all participants. The BENY token is a proxy for that value. The BENY token value reflects demand for pools and is the system’s primary economic reward to incentivize behavior. If the BENY value is too low, it will discourage Pool Managers from participating in the system. If its value is too high, it will deter Participants from using pools. The goal of the BENY pricing policy is to manage its value within a range through the active management of the token’s float.

Token Float = Issued — (Staked + BennyFi System Reward Fund)

The number of tokens available in the market (the float) is controlled by the following factors:

o Inflation

o Deflation

o Demand

Our goal is to completely decentralize the management of the system over time through automation. To achieve this, we must automate the management of the BENY float. For example, let’s say that based on actual demand, the optimal BENY float is 10 million tokens. The Foundation needs to issue 2 million BENY to fund operations. On a timed interval, the system would determine the current float. For this example, if the float is currently 12 million BENY. 12M is 2M greater than the optimal 10M float, so the system would need to deflate the float by 2M to issue more BENY. The deflationary mechanisms are described below. Building an algorithm that selects the correct mechanism(s) to create the desired 2M deflation is complex and will require actual usage data. As the system matures and this data becomes available, it will become possible to completely automated this process. For now, the BennyFi Foundation manages the value of System Settings through its governance process.

BENY Inflation

The BennyFi Foundation is the sole issuer of the BENY tokens. The BennyFi Foundation raises its annual budget through pools that distribute BENY tokens as a staking reward. The rate at which BennyFi Foundation pools are held determines the inflation rate of the BENY token.

BENY Deflation

Several functions within the system are deflationary or can result in deflation. The primary deflationary mechanisms are:

· Entry Fees

· Pool Manager Staking

· Early Exit Fees

· BennyFi System Reward Fund (BSRF)

Fees are variable, allowing for increases or decreases to encourage specific behaviors. Fees can be either recycled back into the system through system rewards or taken out of the float permanently through burning. The system rewards temporarily take tokens out of the float because fees accrue in the BennyFi System Reward Fund (BSRF) until the rewards are paid out.

BENY Demand

Demand for the BENY token is created through participation in BennyFi pools. Pools are created by Pool Managers. Pool Managers derive economic benefit through commission and system rewards, which are distributed proportionally based on the Pool Manager performance. (See BennyFi System Reward Fund for more details)

BENY Transfer

BENY tokens are transferrable without any restrictions with the exception that the token holder must agree to the system’s Terms of Service to use the platform.

Entry Fees

BennyFi pools require the payment of an entry fee from participants to enter a pool on the platform. The entry fee is calculated based on the pool type and the value that the pool yields to the participants. The higher the expected yield, the higher the entry fee. The entry fee can be paid by the Pool Manager, the Beneficiary or divided equally among the Participants, or any combination of these three options. For example, a Pool Manager can pay 25%, the Beneficiary can pay 25% and the remainder would be split equally among the Participants. BENY tokens are used to pay the Entry Fee. At the end of the staking period, entry fees are either transferred to the entry fee account and become part of the BSRF or burned based on the value of the {ENTRY_FEE_BURN} system variable. For a detailed explanation of how the entry fee is calculated please see “Entry Fee Pricer” section in the Technical Overview section below.

Pool Manager Staking

Any registered user with enough BENY can elevate their status to PM. The amount of BENY necessary to elevate a user’s access level is determined by the value of the ROUND_MANAGER_STAKE_AMOUNT system variable. The value of this variable is managed as part of the system pricing policy and the governance of the system. In general, the staking amount increases with the number of PMs.

Early Exit

The early exit functionality allows any Participant, Pool Manager, or Beneficiary to exit the pool early for a fee. For example, ProjectX has just completed a successful 90-day PledgePool and will be receiving 10,000 in staking rewards at the completion of the pool. But ProjectX needs the funding now, so they elect to take the early exit option allowing them to exit the pool today with their funding minus an early exit fee.

BennyFi System Reward Fund

The System Reward Fund (BSRF) compensates Pool Managers for running successful pools and enforcing the system’ s Terms of Service. BennyFi usage fees accumulate in the BSRF account and are paid out periodically. Currently, the BSRF has five funding components:

· Entry fees

· Usage fees

· Early exit fees

· Marketing support fund

BennyFi System Reward Fund Payout

PMs are entitled to a percentage of the reward pool based on their performance. Performance is determined by the number and yield of successful pools completed by a PM compared to the total number and yield of all pools for a given period. The Reward Pool payout is as follows:

· System Reward Fund = (Entry Fees + Usage Fees + Early Exit Fees + Marketing Support Fund)

· Pool Manager’s Payout = Pool Manager’s Pool Staking Rewards / Total Staking Rewards of all Pools

· Example: PM raised 10,000, All pools raise 100,000, Reward Pool is 10,000. PM’s payout is 10% of the Reward Pool, 1000 BENY.

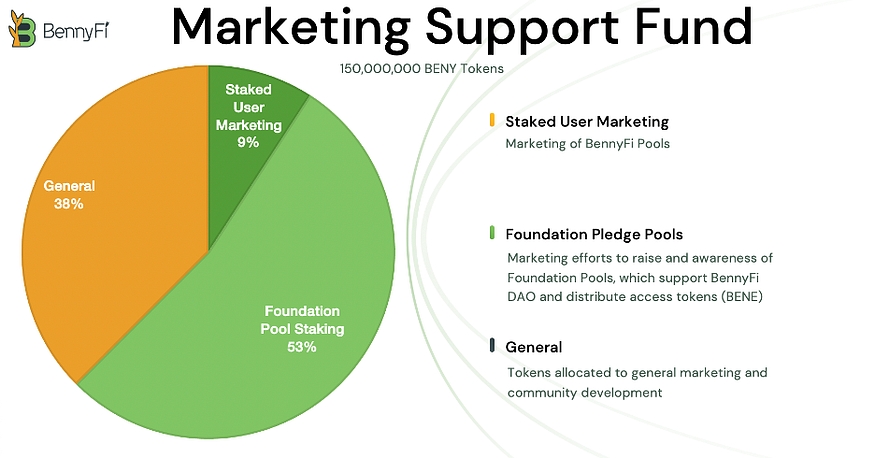

Marketing Support Fund

The Marketing Support Fund rewards Pool Managers meeting the Foundation’s marketing goals. Annually, the Foundation approves a budget that includes an allotment of BENY tokens to fund the Marketing Support Fund and a detailed description of the marketing goals the Foundation is willing to pay for. A new user bounty is a good example.

Marketing Support Fund Allocation

Token Allocation

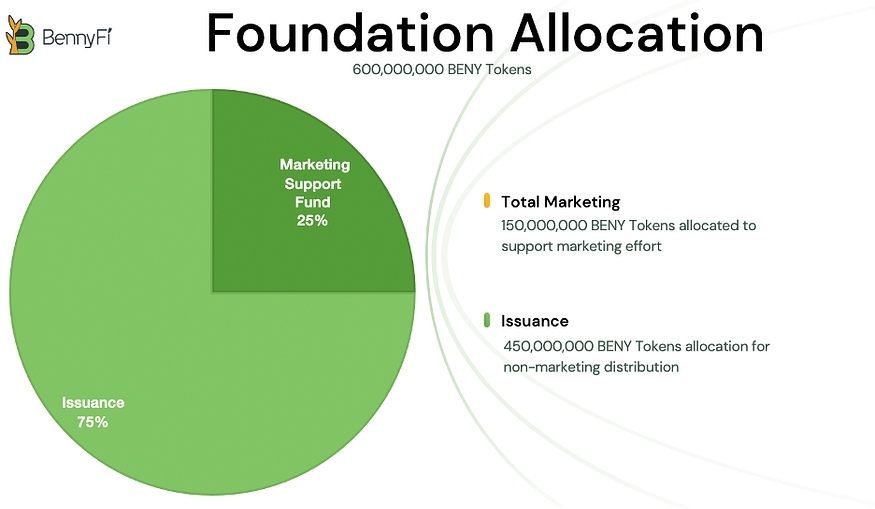

Foundation Token Allocation

Last updated