Governance

Governance

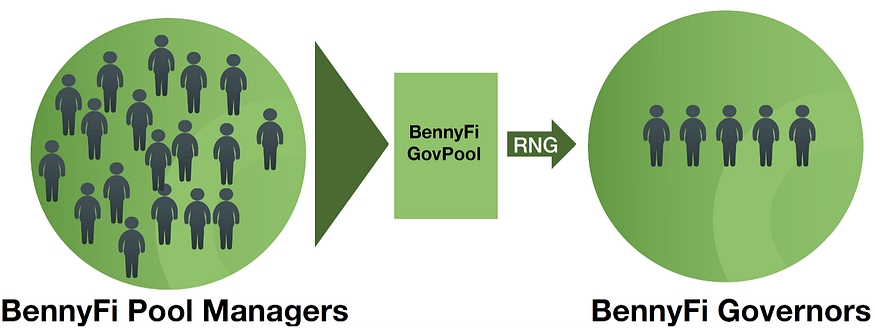

The BennyFi Foundation is a Decentralized Autonomous Organization (DAO) governed by its Pool Managers (PM). The BennyFi Foundation is responsible for proposing the platform’s roadmap and setting pricing policy through the value of its system variables and an annual budget. The goal of the governance system is to create a workable control system without the need for a single controlling entity. Decentralized governance systems are relatively new and often produce unintended consequences. Early DAOs, with one token and one vote governance systems, were vulnerable to capture, and a small group of token holders with many tokens could effectively capture control of the DAO. To guard against this, BennyFi’s governance system separates voting power from the BENY token by employing a random distribution of voting rights. Governors are selected randomly from the universe of all Pool Managers making it difficult and expensive to accomplish a successful 51% governance attack.

Voting

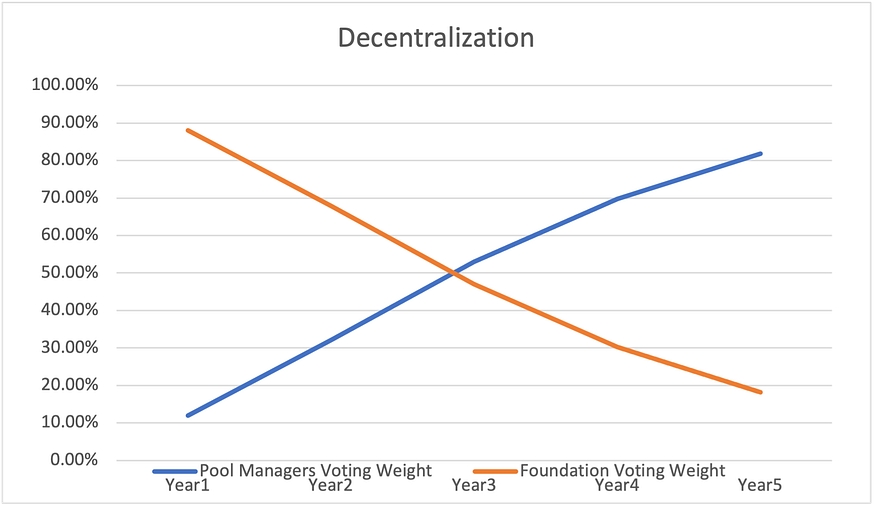

The BennyFi platform is controlled by a system account that requires multi-signatures. All system-level changes must be approved by a majority of the signatories. The behavior of the BennyFi platform is controlled through the value of its system variables. The set of these system variables equates to the platform’s governance policy (see System Variables below). Governors are selected randomly from the group of all Pool Managers and serve for a defined term. After the completion of a governance pool, new Governor accounts are added to the system account and old Governor accounts are removed. Each Governor has a voting weight of 1, meaning that each Governor has one vote. All Governors are eligible to vote on governance proposals. The Foundation will have an initial voting weight of 200, meaning that it would take 201 Governors to outvote the Foundation. Over time, the increasing number of Governors will dilute the voting weight of the Foundation and decentralize the governance of the platform. Until that happens voting power will be concentrated in the Foundation. It is important to note here that decentralized governance systems are relatively new and notoriously difficult to test prior to release. It is often necessary to modify a decentralized governance system to account for unanticipated behaviors. No governance system is perfect. BennyFi governance will evolve over time based on the requirements of the community.

Decentralization

Careful consideration has been given to the smooth transition of voting power from the Foundation to the community to achieve decentralized operation. In our estimation, BennyFi becomes decentralized when the Foundation controls less than 20% of the voting power. The following graph represents an illustration of the decentralization process. As the number of Governors increases, the voting weight of the Foundation decreases.

Pool Manager staking is one of the primary deflationary mechanisms in the token model. The issuance of BENY may vary up or down, depending on the system’s pricing policy and the Foundation budget requirements (see Token Model above). The issuance of BENY and the management of its value will affect the rate of system decentralization.

Last updated